Hello Holders! In this article we will look at the cryptocurrency investment strategies by creating an optimal portfolio using an Efficient Frontier and optimal cryptocurrency weights.

Modern Portfolio Theory.

Let’s take a look at Modern Portfolio Theory (MPT), which suggests that investors are risk averse. We have two or three portfolios with the same yield and investor will choose the one and with the lowest risk.

In accordance with this, if a portfolio has a high portfolio risk and the investor will choose the portfolio because that assumes a higher return. The theory of building optimal investment portfolios was first proposed by Harry Markowitz.

Risk and return.

According to Harry Markowitz, any investor should base his choice solely on expected returns and standard deviation. Summary, having carried out an assessment of various combinations of portfolios.

As a result, he must choose the “best” one and based on the ratio of the expected return and the standard deviation of these portfolios. The ratio of the return-risk portfolio remains normal: the higher the yield, the higher the risk.

Low correlated portfolio

The main task of the investor is to make a portfolio of assets with weak or negative correlation. Portfolios with a correlation coefficient of 1 would be risky and with -1 less risky. But in practice it is rare.

As a result, with a large number of assets because the risk is also correspondingly reduced than with two assets so we diversify the portfolio.

You can check the correlation of your cryptocurrency portfolio in the correlation matrix section on holderlab.io

Efficient Frontier

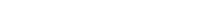

Markowitz put two parameters at the head of his theory – risk and profitability. An efficient frontier is one that defines the effective set of portfolios on it, respectively, between risk and return. Let’s look at an example:

1 Portfolio – low return and low risk

2 Portfolio – high return and high risk

3 Portfolio – effective portfolio

4 Portfolio – not effective portfolio

All investment portfolios that are on the border will be effective. With the existing risk, the other portfolio will have lower returns. Therefore, the investor can choose the appropriate risk and select the optimal yield.

As a result of MPT, using an efficient frontier will be the selection of the optimal weights of each asset in the portfolio.

Let’s go research cryptocurrency portfolio!

We decided to take the 12 largest cryptocurrency by capitalization and evaluate 5000 possible portfolio options that can be. This is our cryptocurrency investment strategies.

With the help of holderlab.io you can find the efficient frontier of your portfolio.

For instance we take for research: BTC, ETH, XRP, LTC, BCH, EOS, BNB, BSV, TRX, XLM, ADA, XMR because they the largest in terms of capitalization.

First, let’s look at the profile of the correlation matrix for 1 year from 2018 to 2019.

The 1-year correlation is very high. Cryptocurrency Asset Correlation Information:

| Bitcoin | 0,842 |

| Ethereum | 0,873 |

| XRP | 0,851 |

| Litecoin | 0,895 |

| Bitcoin Cash | 0,895 |

| EOS | 0,861 |

| Binance Coin | 0,884 |

| Bitcoin SV | 0,797 |

| Cardano | 0,834 |

| TRON | 0,813 |

| Stellar | 0,687 |

| Monero | 0,9 |

After that, we test the asset ratio for the last 3 months. Starting from April 15, 2019

| Bitcoin | -0,057 |

| Ethereum | 0,173 |

| XRP | 0,532 |

| Litecoin | 0,505 |

| Bitcoin Cash | 0,635 |

| EOS | 0,493 |

| Binance Coin | 0,554 |

| Bitcoin SV | 0,565 |

| Cardano | 0,561 |

| TRON | 0,579 |

| Stellar | 0,39 |

| Monero | 0,52 |

The results are already better because Bitcoin has a negative correlation therefore this is a fairly short period for analysis using the correlation matrix, however, we will look at the profile of the efficient frontier.

Calculation of the efficient frontier of a cryptocurrency portfolio for 2019

In cryptocurrency investment strategies we analyzed a sample of portfolios from the beginning of 2019. 5000 cryptocurrency portfolios were analyzed.

Let’s look at the results:

The optimal portfolio distributed weights as follows:

| Bitcoin | 28,86% |

| Ethereum | 1,26% |

| XRP | 10,23% |

| Litecoin | 7,32% |

| Bitcoin Cash | 3,92% |

| EOS | 0,93% |

| Binance Coin | 11,99% |

| Bitcoin SV | 17,8% |

| Cardano | 7,57% |

| TRON | 6,48% |

| Stellar | 0,58% |

| Monero | 3,06% |

| Returns | 0,02886 |

| Volatility | 0,0743 |

| Sharpe Ratio | 0,38838 |

We see that, EOS and XLM received a distribution of less than 1%, while Bitcoin was 28.86%, respectively, we have recently seen the dominance of Bitcoin and the fall of altcoins.

In order to evaluate the results let’s test the optimal portfolio and compare it with the proportional distribution of % in the portfolio.

Backtest Cryptocurrency Portfolio

Using the holderlab.io backtesting module so we tested the optimal portfolio from the beginning of 2019, the weights of which were calculated using the efficient frontier and obtained the following results:

| Profit 127.21% | Max.Profit Peak 227,79% | Max. Drawdown -24,26% | Standart Deviation 66,6% |

Let’s look at the results of the backtest of proportional distribution:

| Profit 94.65% | Max.Profit Peak 192,97% | Max. Drawdown -18,9% | Standart Deviation 57,88% |

Profit was lower at 32.56 and then the drawdown decreased by 5.36%.

But we assume a high correlation of the cryptocurrency portfolio we have chosen for analysis, therefore, we need to further combine altcoins with a medium and medium-small capitalization.

Summary, it can be noted that Modern Portoflio Theory, including the efficient frontier because they can be applied to cryptocurrency portfolios and searching for the optimal portfolio weights.

**The examples above are not a recommendation or investment guide.

Holderlab.io is a free service for automated crypto portfolio management with automatic rebalancing of assets (threshold or periodic), searching for efficient frontier and analysing assets using a correlation matrix and other crypto investments tools.