Greetings Holders. Today we want to talk about trailing stop loss strategy. It is quite difficult to constantly monitor the dynamics of a crypto portfolio. Especially for portfolios with a large diversification.

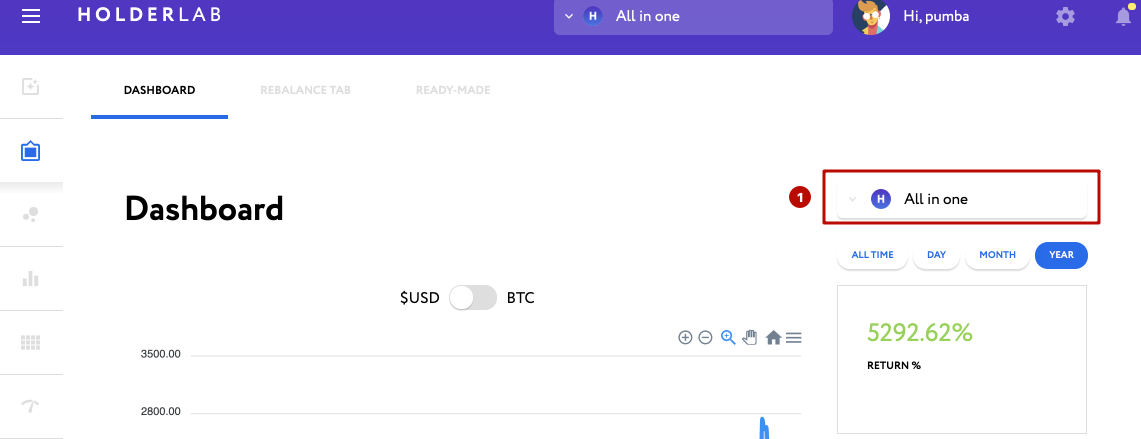

Now in Holderlab.io, when drawdowns occur, you can set an automatic trailing stop for your entire portfolio.

What is a trailing stop?

Stop loss minimizes losses if the price of cryptocurrencies starts to move in the opposite direction. Trailing – stop allows you to automatically set a stop loss and move depending on the set value.

Trailing stop loss for a cryptocurrency portfolio.

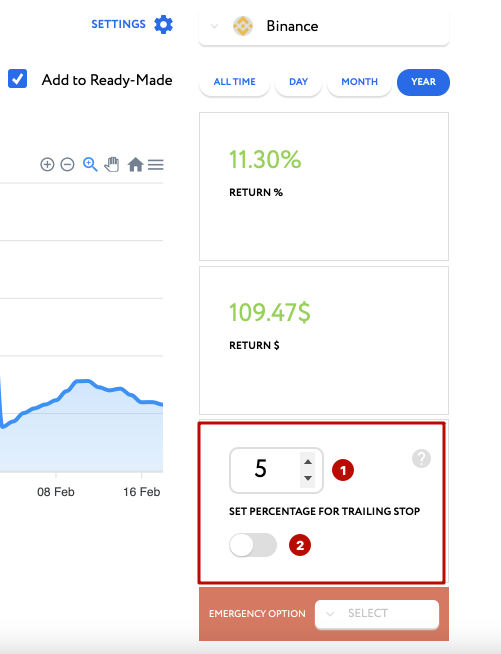

In our case, when we are dealing with a cryptocurrency portfolio, a large number of assets and rebalancing, the trailing stop function allows you to disable rebalancing. It allows you to notify the investor about the occurrence of an event using a trailing stop. After that, the investor himself can decide how to proceed with the portfolio positions.

For an emergency sale, or rather rebalancing in the event of a sharp drawdown, we have provided an emergency option to rebalance the entire portfolio in BTC or rebalance the entire portfolio in USDT, just in case.

Not just trailing stop at Binance.

For any connected exchange in Holderlab, you can set a trailing stop value.

How to set trailing stop loss in Holderlab?

- Select the exchange you are interested in to set a trailing stop, then you will see a window that appears for setting a trailing stop.

2. Set the required value for the trailing stop triggering. Drag the slider to activate the trailing stop loss strategy.

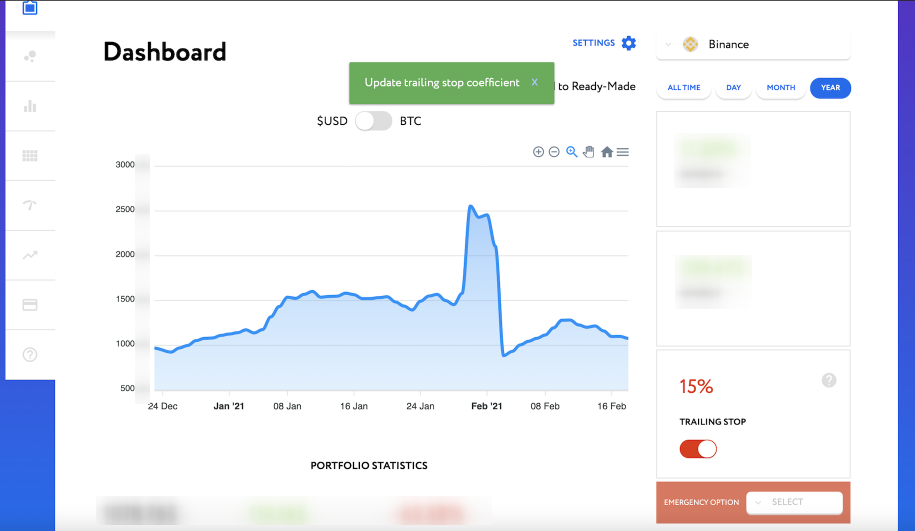

3. Upon activation, you will see a popup with a successfully set stop loss.

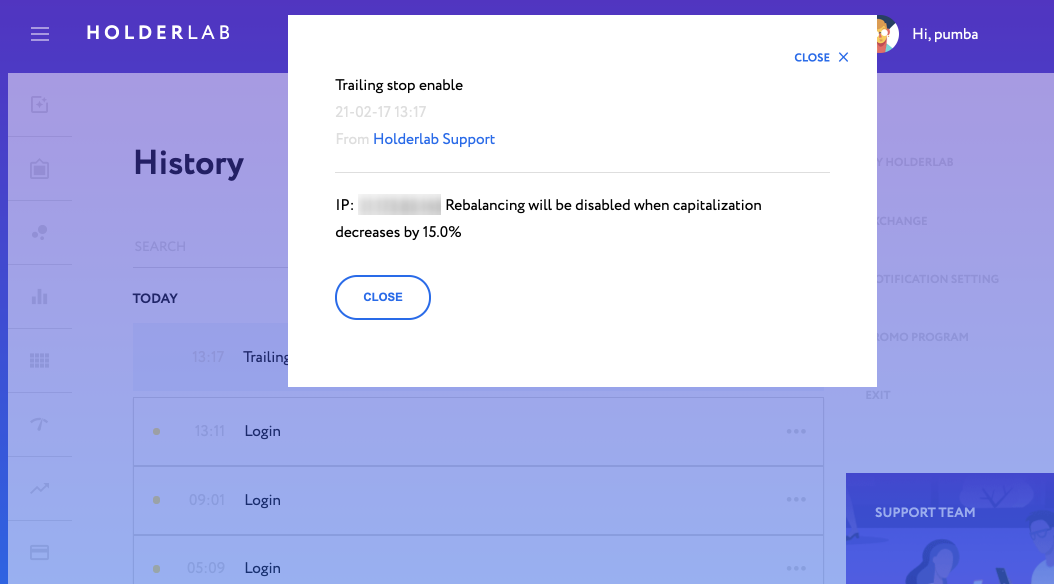

4. In the event window, you can see the already set trailing stop loss strategy and its description.

Now, when the stop loss is triggered, the set rebalancing will be disabled and you will receive a notification about its triggering.

Successful investment strategies and we recommend reading about the cryptocurrency portfolio backtest.