Let’s take a look at the new auto index rebalancing strategy. At the heart of the crypto index is a combined tool that links portfolio optimization. Portfolio optimization is using the Markowitz method and portfolio rebalancing.

At Holderlab.io, we offer a choice of two timeframes – weekly or monthly. Thus, when choosing a weekly timeframe, optimization occurs once a week. Optimal weights are selected within a week, the same happens at monthly intervals.

How to start portfolio backtesting with the cryptoindex?

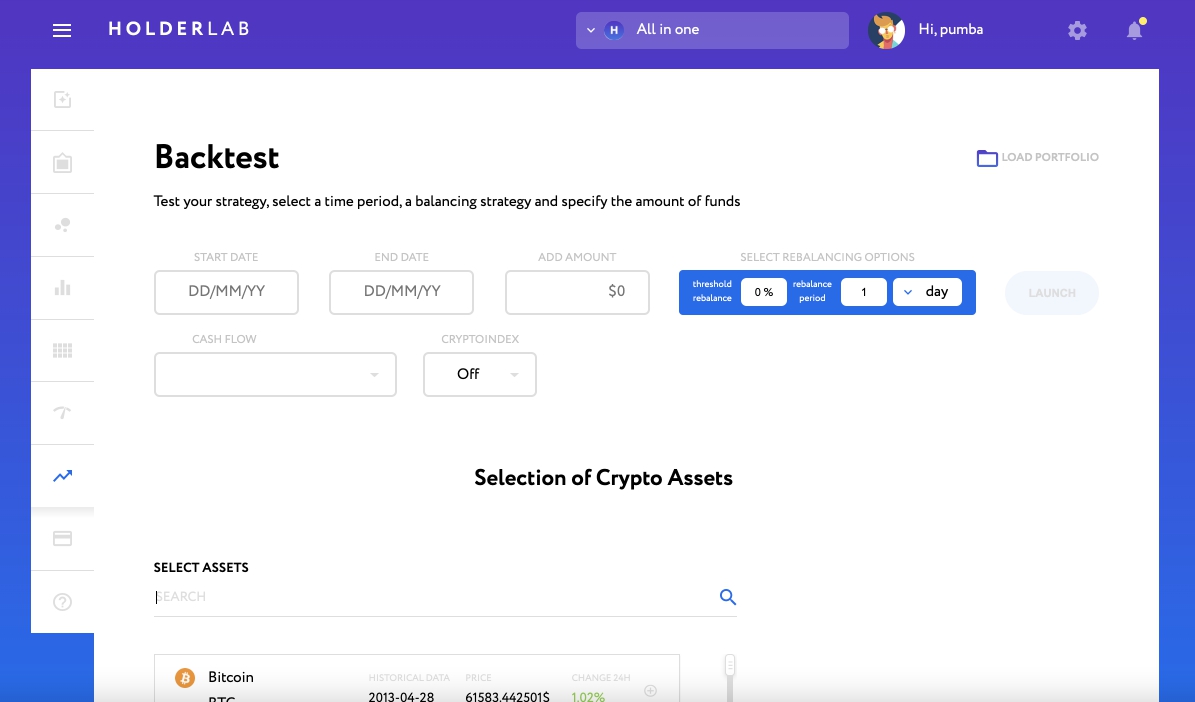

In order to launch an automated strategy for rebalancing the crypto index, you need to go to the backtesting section.The next step involves the need to choose a cryptocurrency exchange.

- Go to the backtest section, select an exchange or select all in one

- Select in the search for cryptocurrencies and collect a portfolio or upload it

- Set test start date, end date and add the amount of funds

- Choose an index rebalancing strategy – weekly or monthly

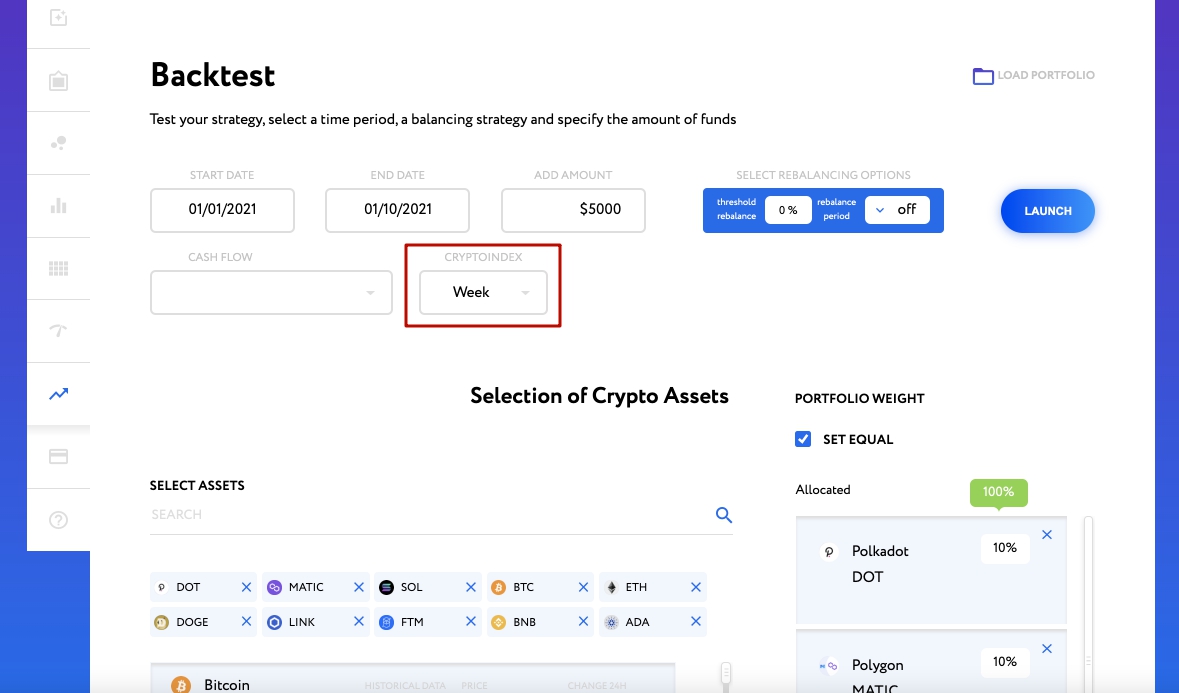

As a hint, when an exchange is selected, you can save your portfolio. This crypto portfolio can be uploaded, for example, to the rebalancing section.

When you have selected the cryptocurrencies that interest you to test using the cryptoindex. It is necessary to set the necessary parameters, and in the next step, select a timeframe for the cryptoindex. It can be either a weekly interval or a monthly and press start. Alternatively, you can turn off rebalancing as the cryptoindex already turns it on.

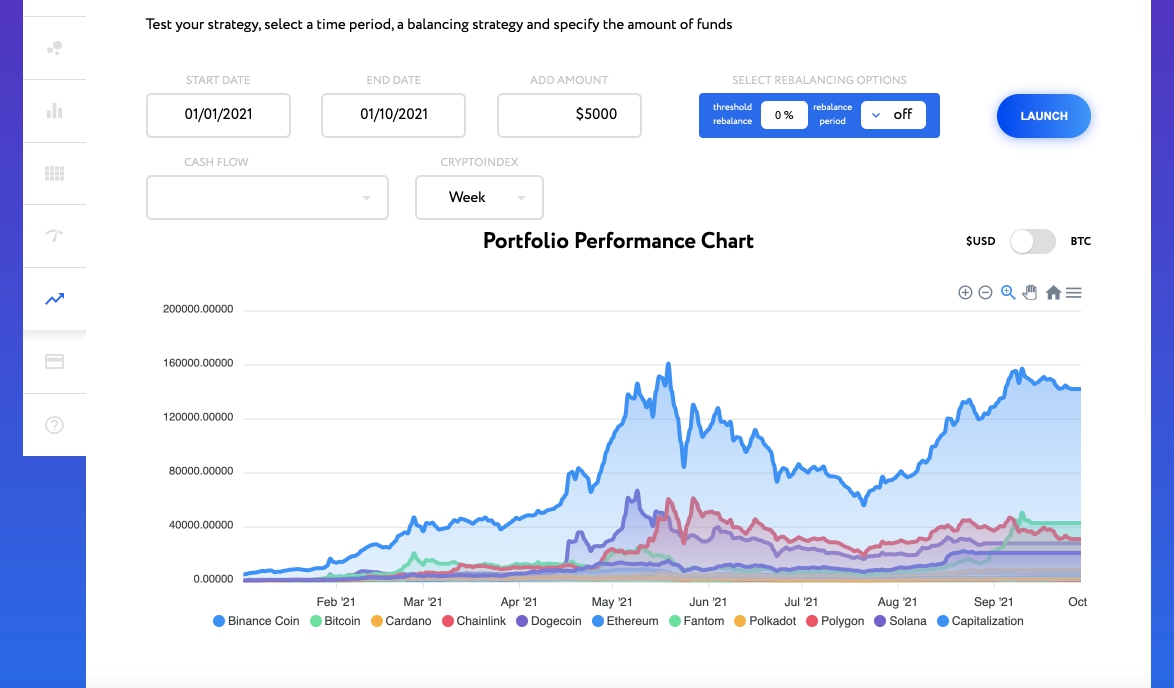

The results of testing a cryptocurrency portfolio using the cryptoindex tool.

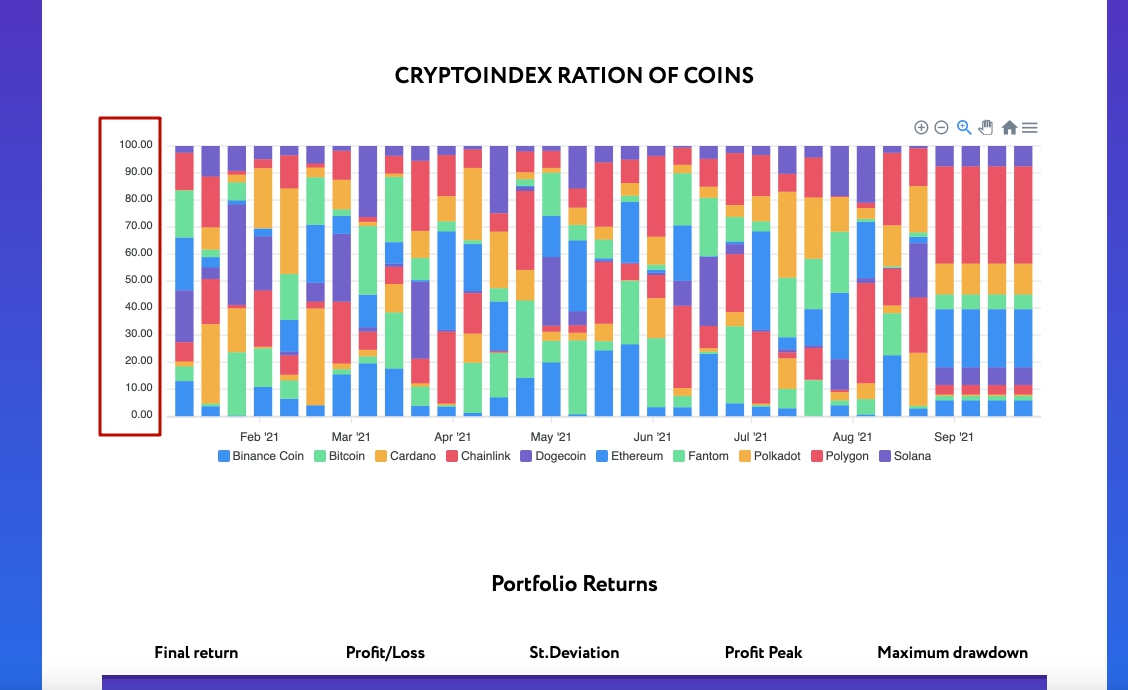

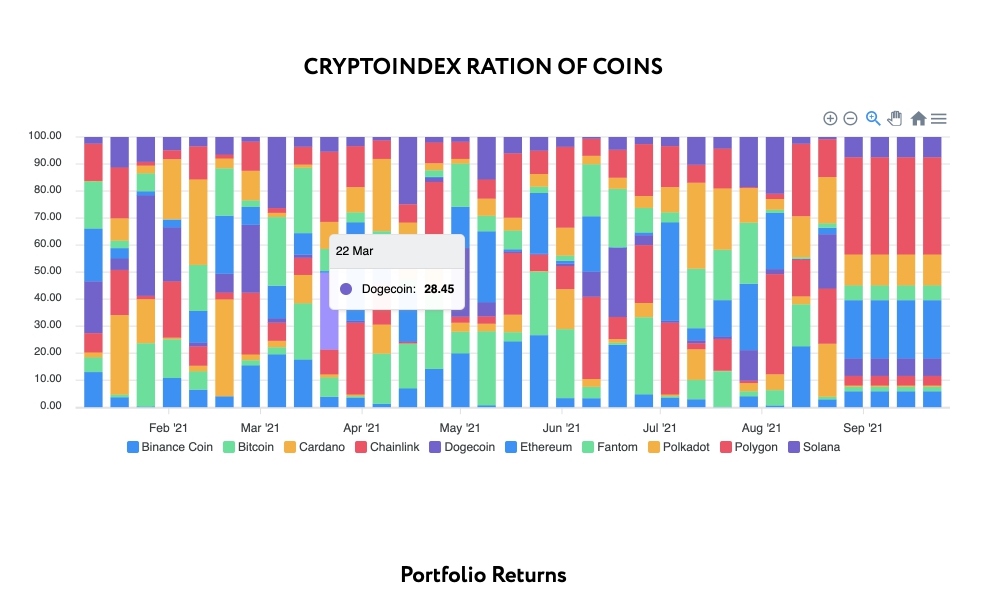

In the results of testing your crypto portfolio using the crypto index, you get a standard graph of the performance of your portfolio. That graph displays the performance of the total portfolio and each cryptocurrency separately.

Automatic index rebalancing strategy

It will show you the distribution of your optimized coins for the period you selected. In simpler words you will see how your portfolio has been optimized every week, for example.

Here you can see in detail how the portfolio weights changed as the optimization proceeded.

For example, in our case, the optimization is accumulated according to the Markowitz method every week. The next step is rebalancing, thus expressing the essence of the automatic index rebalancing strategy.

Thus, by testing the cryptoindex tool, you can clearly see how this tool works on historical data.

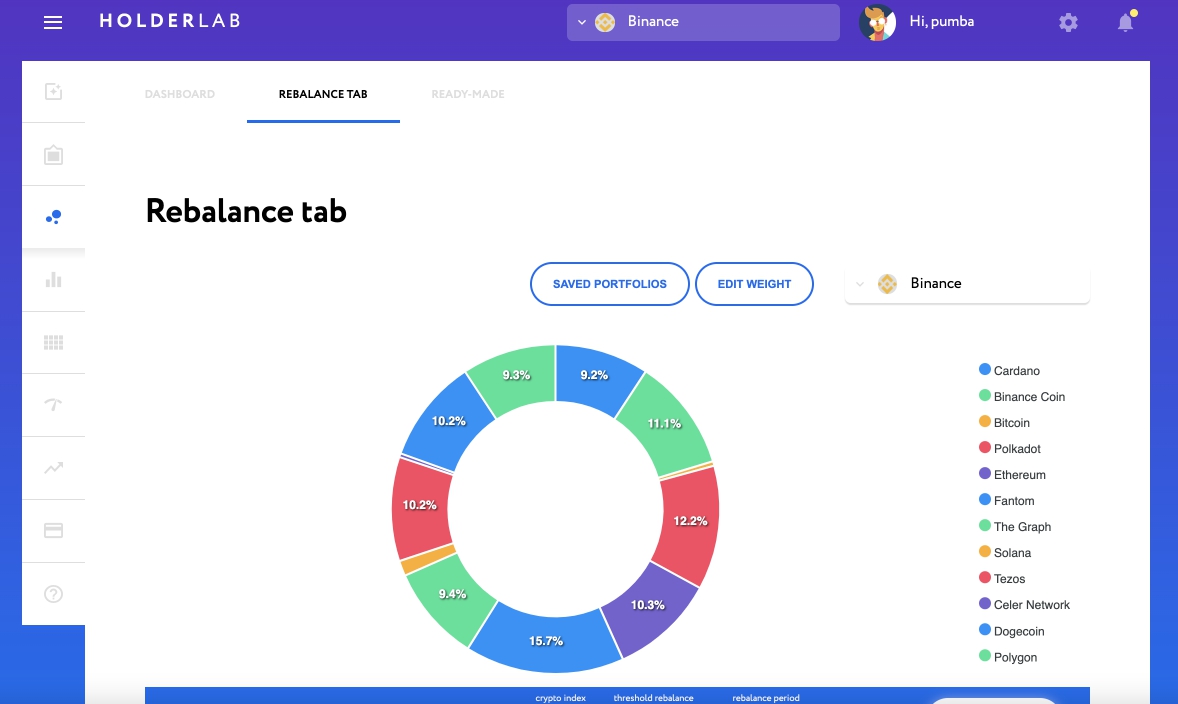

Rebalance index pie chart

In the rebalancing section, you can see a pie chart that will visually show you the updated weights after each rebalancing of the crypto index.