Hello everyone. Below I want to tell you step by step about how, with the help of simple methods and automation of the crypto portfolio, you can achieve good returns of more than 50% per annual by strong cryptocurrency portfolio management.

Attention: This material is for informational purposes only and is not a recommendation for investment. Consult your financial advisor before making financial decisions.

If you know how to recognize the next pump of the next ico project, then this article is not for you. We intend to focus on a long-term strategy for the formation of an income crypto portfolio with minimal subsequent involvement.

Rule 1. Determine your investment horizon and goals for the price.

Why is this useful? Firstly, you will not worry about minor market fluctuations, understanding your investment goals (time and price goals). Secondly, you will not do premature actions, for example, as a way out of some positions. Of course, this may be justified, but often you can exit the position during the usual technical correction before the next growth.

Rule 2. Diversification.

Yes, most cryptocurrencies strongly correlate with each other, recently even bitcoin showed a strong correlation with the S&P 500 index, but our task is to get maximum profitability with minimal drawdowns. Therefore, do not ignore stablecoins, exchange cryptocurrencies, do a backtest of your crypto portfolio.

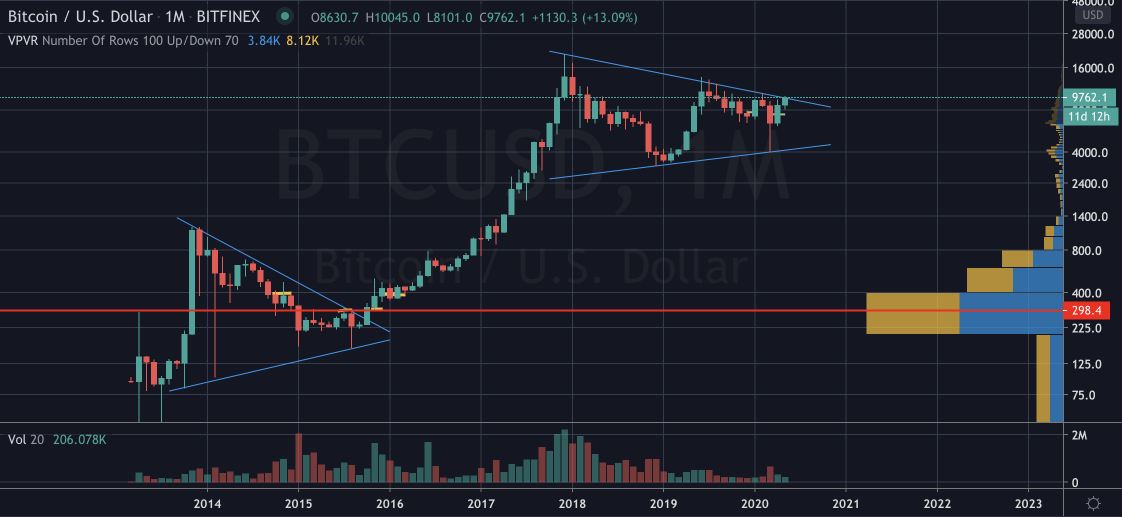

Rule 3. Load a portfolio with Bitcoin whales.

The market can be in two stages – balance and imbalance. Looking for loading points, when you see that a position is being accumulated, it can be triangles or flat corrections. The whales accumulate a position gradually, keeping (as if squeezing) a position in a given range, since the volumes of their positions can be very large. You can find the optimal loading levels using the horizontal volume indicator.

How to distribute a portfolio?

In the stock market, as a rule, you can load a portfolio proportionally from 1% to 5% for each position, depending on the risk. In cryptocurrencies, things are different, no one is protected from the pump and dump of the alts, so you should distribute the main weight among the top cryptocurrencies, starting with Bitcoin.

Markowitz method.

Harry Markowitz received the Nobel Prize for the theory of modern portfolio. The method allows you to automatically calculate the optimal weight in the portfolio. You can choose the optimal weights for your portfolio using the optimization module in Holderlab.io

Rebalancing.

Thanks to competent rebalancing, you can increase the profitability of your portfolio. By returning the normal distribution of the portfolio, selling expensive cryptocurrencies and buying sagging, you allow you to increase the profitability of your cryptocurrency portfolio management in a growing market. However, this is a difficult task, manually calculating the shares in the portfolios. Better automate this process with Holderlab right now.

Social portfolios.

There is another crypto hack. You can copy the portfolio to another investor. Below is an example of the profitability of other participants

To do this is quite simple by clicking the get pack button. Moreover, you have 7 days of free access in Holderlab.

Follow Holderlab.io on

👉Telegram: https://t.me/holderlab

👉Twitter: https://www.twitter.com/gotoholderlab

👉Facebook: https://www.facebook.com/holderlab/