Price is not in a state of random wandering; it is moving from a state of balance and imbalance. Therefore, large players such as Bitcoin whales can control the accumulation and distribution of prices.

Who are Bitcoin Whales?

These are especially large holders of bitcoin 100 – 10,000 BTC and more. These are mainly early buyers and owners of bitcoin, as well as the government. In addition, key crypto exchanges and various funds are major holders and the most interesting is that all these bitcoin kits directly affect the price movement.

Cryptocurrency market manipulations

Of course, bitcoin whales have a significant impact on the cryptocurrency market. The price of Bitcoin and other cryptocurrencies is not in a chaotic wandering, you should understand that it is the large holders of bitcoin positions that shape the market and direct it. This is due to the emergence of accumulation and subsequent distribution of prices. Price always moves in two states – balance and imbalance.

How do Bitcoin Whales accumulate their positions?

Surely you have come across such technical analysis figures as a triangle, flat correction and other figures that talk about price consolidation.

It is precisely such figures that allow bitcoin whales to accumulate their positions. They seem to tighten the price by keeping it in the range they set for the purpose of accumulating positions.

Price and volume

With the help of the volume indicator, we can see the actions of large players who are interested in a certain purchase price of Bitcoin. How can this interest be discovered? Below on the graph, we added indicators of the volume of their peaks (marked with yellow circles) and compared them with the boundaries of the forming triangle (marked with red circles).

Thus, we can say that the price movement in a certain range (accumulation phase) is characterized by the release of large volumes in order to maintain a given average price value.

How to determine Bitcoin Whale download levels?

Large players, usually having large volumes, want to buy at the desired price. We just wrote about this phenomenon above, as a result of which the price is kept in the specified range, forming the level of purchase at the average price. In general, you need to understand that the market is driven by large players from the stage of balance to imbalance. Therefore, in our arsenal there should be a tool that allows you to determine the loading levels of large players or smart money. And this tool is volume analysis.

At what price did players buy bitcoin?

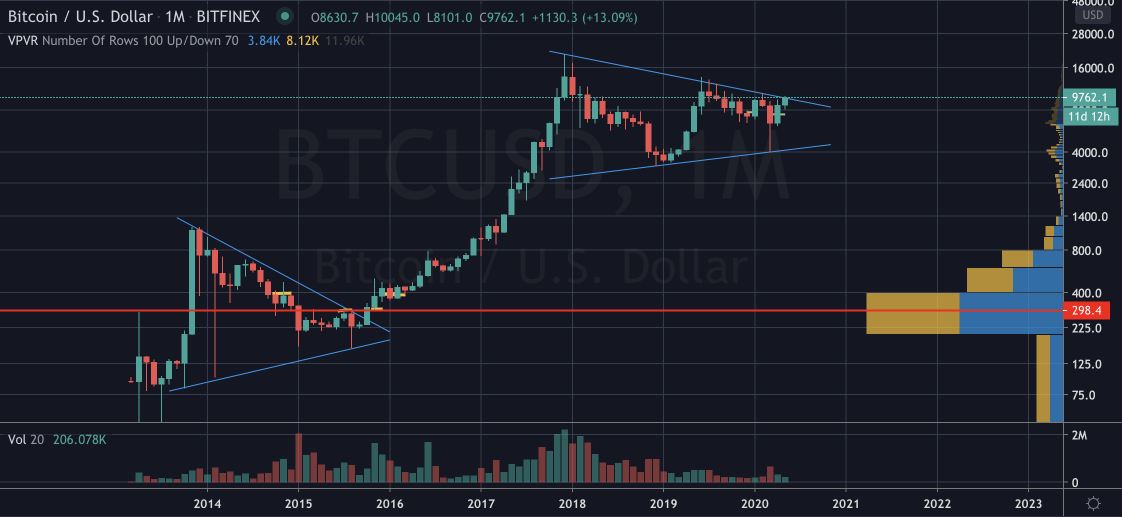

Let’s turn to historical data. For this, it is best to use a logarithmic graph.

Using the horizontal volumes shown on the right, we can determine the average load price. The maximum volume from 2013 to 2015 was on average at the load level of $ 298, as soon as the accumulation phase was over, the distribution phase began, as a result of which Bitcoin grew by 6450% in 792 days. In fact, the load level of $ 298 is the average price of the load range, which is presented on the horizontal volume of this candle.

What levels are Bitcoin buying now?

Similarly, we can consider the next triangle, which has been forming since 2017. By the way, the triangle is a correction figure, and we can now say that at this moment the accumulation of the next position of major players is being formed. Let’s take a closer look at the current situation.

As we see the maximum volumes were at the level of 4023, a pretty good position for purchasing in the current situation. Another potential load level was the level of 6432. And in principle, it became the main average load level.

We have examined in detail the loading levels of large players with you and will monitor the situation.

Because now we know that the way out of this consolidation will be characterized by a further distribution of prices.

Holderlab.io is a cryptocurrency portfolio management automation software. It will help you to analyze your portfolio using the correlation matrix and the optimization method.