Many investors are already rebalancing their crypto portfolios, but how does choosing a rebalancing strategy affect the drawdown of your portfolio? Is a crypto investor ready to volatilize his portfolio in the crypto market and get a drawdown of 20% or even 50%?

Rebalancing gift for the investor.

The advantages of portfolio rebalancing are great among all other strategies, and one of these advantages is that automatic rebalancing eliminates emotions from investment decisions. And this is a great gift for an investor.

Investment horizon

It is also worth noting one of the features of the rebalancing strategy, rebalancing can give the first results in the long term investment. A crypto investor needs to have its own investment horizon. This may be an additional factor to reduce the influence of emotions on the process of making investment decisions in the cryptocurrency market.

What is a rebalancing of a crypto portfolio?

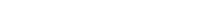

Rebalancing a crypto portfolio is the adjustment of cryptocurrencies in a portfolio by selling and buying cryptocurrencies in order to restore the initially selected distribution of cryptocurrencies in the portfolio.

Rebalancing a crypto portfolio is a key element of an asset allocation strategy. Beginners often do not understand why to sell cryptocurrencies that have grown in price and buy those whose price has declined in other words, to do what crypto media and crypto blogs are not advised to do. Let’s look at an example below.

As we see the redistribution of funds between cryptocurrencies, those are the partial sale of Tezos and Bitcoin and the purchase of Litecoin whose share has decreased compared to the planned one. Thus, we keep our risk level near the point at which we are most comfortable.

Rebalancing the cryptocurrency portfolio smoothes out the profitability of our crypto investments, forcing us to “buy low” and “sell high”. Using the rebalancing tool in Holderlab.io, you can start “buying cheaply” and “selling expensively” your cryptocurrencies.

Optimal rebalancing frequency

How often do you need to rebalance crypto portfolio and what is its optimal frequency?

Probably frequent transactions can lead to costs that can reduce the overall return on investment in the long run.

On the other hand, insufficiently frequent rebalancing may lead to the omission of the optimal opportunity to reduce risk.

Two types of automatic rebalance crypto portfolio in Holderlab.io

The first strategy is to rebalance crypto portfolio every time a cryptocurrency grows to a certain threshold.

Let’s look at the test result of the above distribution of cryptocurrencies: 5% threshold rebalance.

Result: P&L – 117.68%, Max.drawdown – 79.87% (due to the fact that our test portfolio is not too diversified)

Further, we suggest looking at a chart of all possible distributions of threshold rebalancing and their profitability and maximum drawdown.

As we can see from the diagram, we did not calculate rebalancing beyond the threshold of 6%, as the drawdown of the portfolio became more than 95%. Obviously, we will not be able to allow such a drawdown value and this is also probably due to the diversification of our portfolio and correlation.

Correlation estimate for 1 year. We see that three of our four assets are highly correlated with each other.

Periodic rebalance crypto portfolio.

This method allows you to rebalance with a certain frequency: hourly, daily, monthly or once a year. Let’s look at an example below using rebalancing hours.

As we see the return of the portfolio is quite restrained with an increase in the hourly period of rebalancing. Portfolio drawdown does not grow exponentially, as is the case with threshold rebalancing. The decrease in profitability and the increase in drawdown, as we see, occurs starting from the 8 hour rebalancing period.

Let’s look at the results of the daily and weekly periods.

As we see, the drawdown has increased significantly compared to the hourly periods, while the risk and profitability are comparable to the threshold rebalancing values.

Summary

In this article, we examined the principles of rebalancing and the need for its use. Our test portfolio was not very diversified, and part of the assets correlated strongly with each other. In the following articles, we will look at the diversification of crypto portfolios and their relationship with risk and profitability.